how much is inheritance tax in wv

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax.

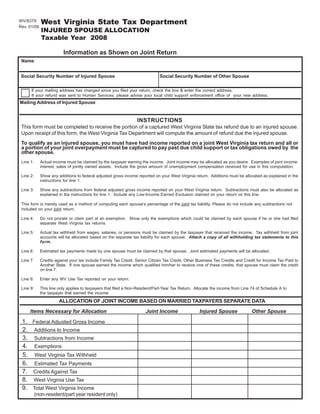

Wv8379 State Wv Us Taxrev Forms

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

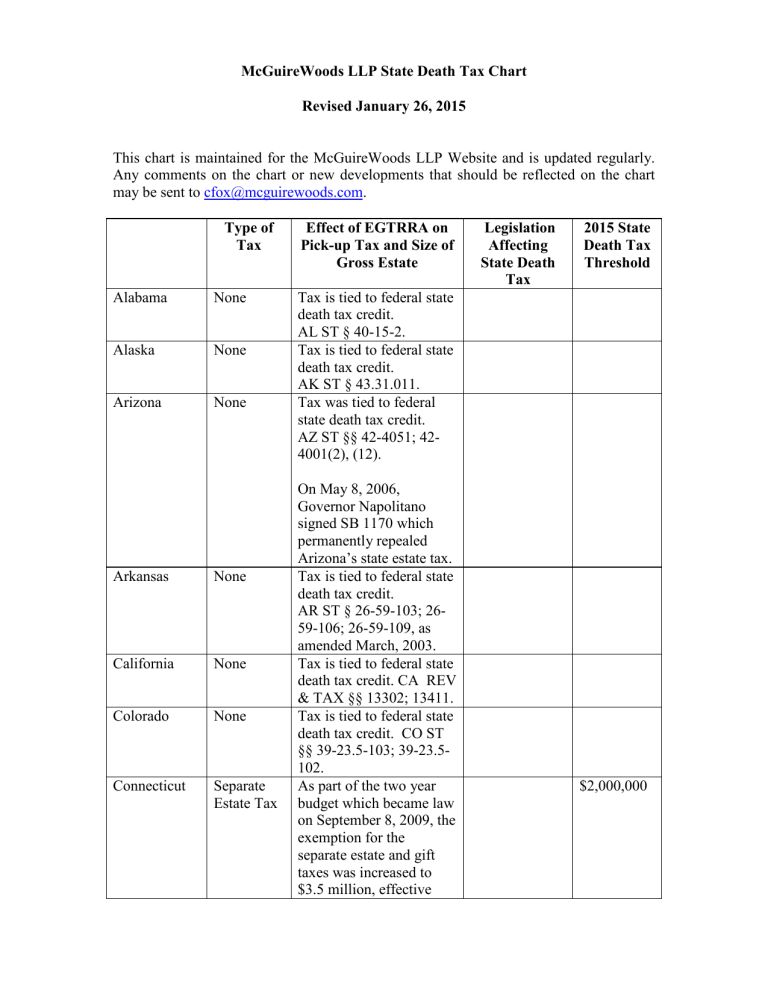

. Each state has different estate tax laws but the federal government limits how much estate tax is collected. The top estate tax rate is 16 percent exemption threshold. Paying for the funeral and burial of your loved one.

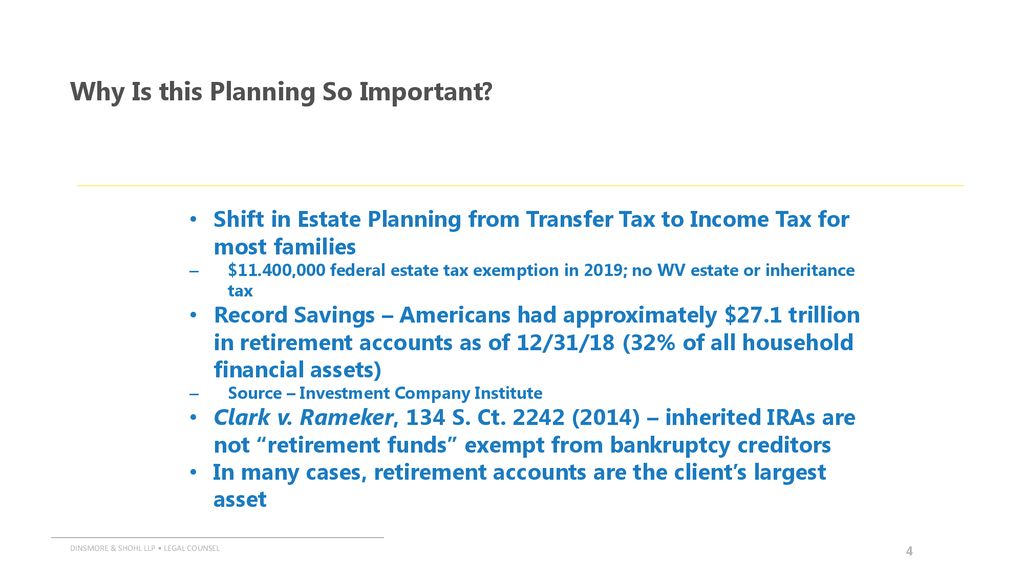

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption. If the gross estate does not exceed the. Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000.

However state residents must remember to take into account the federal. The Economic Growth and Tax Relief Reconciliation Act of 2001 has also eliminated the estate tax in West Virginia. No estate tax or inheritance tax.

The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million. If you are a sibling or childs spouse you dont pay taxes on inheritance under 25000. 2193 million Washington DC District of Columbia.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. West Virginia collects neither an estate tax nor an inheritance tax. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

And like every US. 13 rows West Virginia Inheritance and Gift Tax. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount.

There is no inheritance tax in West Virginia. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of the estate. West Virginia collects income taxes from its residents at the following rates for single head of household and married-filing-jointly taxpayers.

The top estate tax rate is 20 percent exemption threshold. 77 Fairfax Street Room 102. 56 million West Virginia.

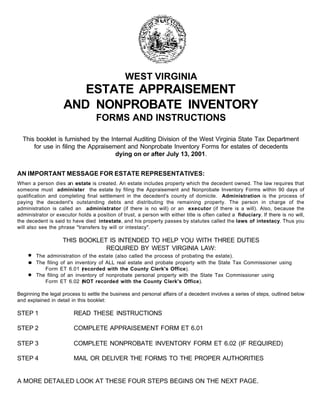

West Virginia collects neither an estate tax nor an inheritance tax. If you own assets worth more than 1 million in 2020 estate taxes will. Paying for the fees associated with the West Virginia probate process.

However there are certain cases when West Virginia residents may find themselves responsible for federal taxation that can reach as much as 40 of the inherited estate. How Much Is Us Inheritance Tax 2020. The state probate tax is 10 cents per 100 of the estate value at the time of death.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. No estate tax or inheritance tax. Below are the below examples of rates and exemption rates for US.

If you are a spouse child parent stepchild or grandchild youll pay no inheritance tax as the entire amount is exempt. A few states have disclosed exemption limits for 2022. Anyone else pays inheritance tax of 0 16 but in New Jersey domestic partners are exempt too.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. Technically it can happen in two cases. Berkeley Springs WV 25411.

Iowa Extended family pays a 5 percent tax on the first 12500 of the inheritance and up to 10 percent of estates worth over 150000. An immediate influx of cash. That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property.

3 on the first 10000 of taxable income. The advantages of an inheritance cash advance in West Virginia include. No need to go through a loan approval process.

How Much Is Inheritance Tax In Wv. There is no federal inheritance tax but there is a federal estate tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

In 2021 federal estate tax generally applies to assets over 117 million. Inheritance tax rates depend on the beneficiarys relation to the deceased and. Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Inheritence Estate Tax. Like most states there is no West Virginia inheritance tax.

No estate tax or inheritance tax. No need to go through a bank for the money. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not exceed the 25-percent bracket threshold amount 2 25 PERCENT BRACKET25 percent of so much of the taxable income as exceeds the 25-percent bracket threshold amount but does not.

Us Inheritance Tax Leave Property For Children List Of 13 States And Territories That Impose Inheritance Tax In The United States 2020 Edition American Life Insurance Guide

/usa--west-virginia--charleston--kanawha-river-and-skyline--dusk-CA22372-5a5353d29802070037bb6e5a.jpg)

Dying With No Last Will And Testament In West Virginia

Mcguirewoods Llp State Death Tax Chart Revised January 26

Gift Tax In West Virginia Rules Limits Exemptions

Et601602 State Wv Us Taxrev Taxdoc Tsd

Historical West Virginia Tax Policy Information Ballotpedia

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

How Is Tax Liability Calculated Common Tax Questions Answered

West Virginia Health Legal And End Of Life Resources Everplans

A Guide To West Virginia Inheritance Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To West Virginia Inheritance Laws

A Guide To West Virginia Inheritance Laws

West Virginia Income Tax Calculator Smartasset

Planning With Retirement Assets Ppt Download

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Income Tax Calculator Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die